GDP Regression/Growth : Gross Domestic Product (GDP) measure the aggregate final value of all productions in The Gambia in a given year. Our GDP is estimated at about US$1 billion (GMD45 billion @ D45/$). Our Per Capita GDP is thus estimated at US $500 (population estimated at 2 million). This is only GMD22,500/person

Of the available 11 years out of the 30-year period under review the average GDP growth is/was 5.92%. This is very impressive if true. Probably a world record – not even USA or China or the ‘so called tiger economies of Asia in the 90s’ were able to keep such sustained high growth level.

We’ve reasons to suspect the reported growth rates are either cooked up and/or erroneously computed. The average Gambia did not fare that good in the last 30 years and/or the 11 years of which the numbers are available.

Notably during the height of this period, The Gambia lost GPMB – the ONLY processing (value-added) unit of the main agricultural produce of Gambia. Since then no farm-family can entirely live on agriculture (specifically peanuts) due to several problems compounded by lack of market outlet. Equally Kuntaur and Kaur Mills are gone along with the river transiting operations.

The river lay pretty much fallow. The little fishing operations are largely done by foreign entities – our nation only collects fees and royalties. Not sure tourism has its earlier impacts on our economy. In short and across the board the average Gambian is not economically growing on average 5.92%. Because of continues failures to gather information and properly manage it we completely lack knowledge of what are the inputs of trades like the tailor under my dad’s verandah, the taxi driver at the garage, cottage industries along the banks of River Gambia.

My intuitions are that our GDP is essentially government’s output, Banking and other formal sectors such as SOEs, etc. This has left out all of the rudimentary informal sector including the output of agriculture and team-diaspora.

Domestic Revenue

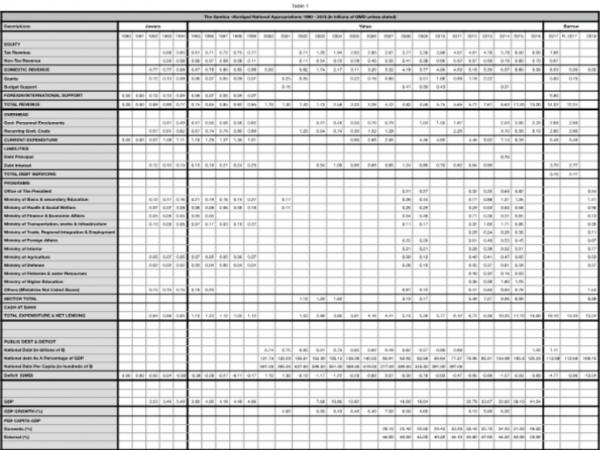

In the 30 years (period wise that’s 58% of our independent nationhood) the national revenue ranges from GMD670 million to GMD9.3 billion. Government (Mr Aamadou Sanneh – Finance Minister) so far failed to provide domestic revenue numbers for 2018, otherwise we can say Gambia never in our 52-year history generate GMD10 billion in revenue. This is about US $222.22 million. That cannot construct a 2-way lane from Banjul to Mansa Konko. The point is our revenue is very small. To our population GMD9.3b/2 million people = D465/person. For growth and prosperity our domestic revenue has to grow exponentially.

Costs of Government/Over Heads

The analysis on costs/over heads are relevant compared to domestic revenues (equity). It’s from revenues our costs are paid from. To include grants and loans in this particular analysis is a mistake. Government’s usually include grants and loans into this analysis to purposefully skew the numbers in favor of their agenda.

Every VIABLE BUSINESS (in this case our government) should be able to pay for her operations from cash flow generated on normal cause of business or will sooner or later be OUT OF BUSINESS. Gambia remained an independent state up until now because of IMF/World Bank propping up our government will the famous budget line called BUDGET SUPPORT.

Under Jawara

In this review and the 5 years under Jawara’s government the average annual revenue was GMD740 million. During the same period Jawara’s government costs (overhead) our nation GMD920 million. This is 124.32% of our revenue on average. These were why in late 70s Gambia couldn’t pay wages, have basic essentials imported, etc. that resulted IMF/World Bank conditioning us into Economic Recovery Program (ERP).

The current left over of the ERP are the SOEs which are now slowly but surely returning into central government purview. Barrow (the latest of presidents) signed a loan for GPA. They are actively involved in NAWEC management and everything electricity. Those are complete contradictions of the performance contracts signed between us (the public) and the Board of Directors of those entities.

They won’t (they don’t) want to let go these entities because they serve them as gateways of all kinds of slush funds to their private and pet projects. Ask yourself in less than 12 months in office where did Barrow’s wife’s Foundation get money to donate a hospital in Gambia. Any day our nation is truly a democratic nation one of the laws would be such foundation disclose their donor list – I will not be surprise if we find Gamtel/Gamcel on it. You think that’s right for Gamtel/Gamcel to pawn our money to private interests when that company is yet to offer our people a free NATIONAL EMERGENCY CALL LINE. Nothing against Gamtel/Gamcel – just used them as example, it could be GPA, SSHFC, etc.

Under Yahya

Per available information for 15 years of the 22 years of Yahya’s government our domestic revenue average at GMD3.73 billion/year and costs of government averages at GMD3.40 billion. This is 91% ratio. Although 9-percentage points less than 100%, this eats up everything we own hence nothing left for social development needs (roads, schools, water, hospitals, waste collection, etc) of our people. The same ratio at 2016/17 (Yahya’s last year in office) stand at 75% of our domestic revenue.

Under Barrow

On June 29 2017, the Minister of Finance, Mr. Amadou Sanneh, came up with what he dubbed ‘2017 Revised Budget’. Some of us making living on numbers are still wondering what period that budget represent. Because is delivered mid-year is it revising for the last 6 months left of this year or a budget for the next 12 months ahead? We cannot imagine the preceding 6 months be included in these estimates. That will break all rules governing budgeting/appropriation.

However, that revised budget kept the same ratios between domestic revenues and costs of government as 2017 – 75%. This in essence left only D0.25b of every GMD1 revenue to social development programs in theory.

Unfortunately, we could not determine this ratio for 2018 because Mr. Sanneh failed to provide the numbers. Surprisingly he told the national a Total Expenditures and Net Lending of GMD13.54b without telling us where that money will come from.

The PRIMARY PURPOSE OF TAXES is not to pay for government. It is to service the welfare of TAX PAYERs. Costs of government is incidental costs to tax payer. It ought to be low and ONLY RELEVANT.

Where 124%, 91% and/or 75% of our domestic revenues are consumed to maintain government are unacceptable. We have to reduce this to below 25% of our domestic revenues. That’s sustainable and will free our meager resources to pay for our welfare need.

Stay connected for PART II

Gambia is unlike most countries due to population contraction. If one subtract all the Senegalese, Ghanaian, Nigerians and other nationals from the sub region, Gambia population will contract significantly. The economic growth numbers of the visitors are huge and the numbers of Gambians are quite small. If one will account for this abberation, GDP growth for Gambia will be reduced significantly closer to 1.34. Some believe that more than half the “inhabitants” are not citizens, resulting in wealth transfer out of Gambia therefore not properly reflected in the numbers. As rightly stated 5.9 is unattainable.

The Minister of Finance, Mr Amadou Sanneh, is reported as saying that government will have no choice, but to increase taxes if budgetary support is not forth coming. And yet, it is the same minister who has presented a budget that allocated more than ONE BILLION DALASIS to Office of the President and Foreign Affairs combined, with the later collecting a cool D872,599,433, whilst the former gets D541,233,948.

Meanwhile Agriculture, supposed to be the backbone of our economy, gets only D526,067,392; even less than that of the Office of the President.

How could you raise revenue within, if you don’t invest, develop and tap into the most productive sector of your own economy?

How could a sane person/persons prepare a budget that is not realistic and will collapse, if it does not receive support from third parties, especially when some of the expenditure items, like D22 Million allocated for “Presidential donations”, is considered?

And when one looks at budgetary allocations to Education (Basic & Secondary; Higher education, Research, Science & Technology) and Health and Social Welfare, one is left wondering whether this lot have got their priorities right. It certainly doesn’t look that way to me, when Higher Educaton, Research, Science and Technology gets an embarrssing D239,941, 950. How do you fulfill the much talked about Youth Development and capacity building when Higher Education gets less than Office of the President? What can we do with less than D300 Million in Higher Education, Research, Science and Technology? Absolute joke.

I accept that the Presidency is a high Dalasi entity but 900M in this our very poor nation is unacceptable, and reflect insensitivity, disrespect and disregard for the citizens of our beloved country. Obviously no rational Gambian will propose such. Let’s all agree it’s a JOKE.

I think Burama is making some good points, but is basing his comments on an outmoded economic template, that is a cost of government measurement.

It is so infantile that it proposes to increase tax revenue by increasing taxes. There is no provision for wealth and new business creation. So logically, the increase in taxation on an underperforming economy, will have the effect of depressing the nations business community, and forcing them to slowly starve to death, as the profit for reinvestment will diminish steadily. This is an overpaid government that does not command the respect of any proven and balanced economist. The IMF will want its repayments guaranteed. Hence they will support any increase in pressure on those working or guiding a business to pay more income tax and the dreaded IMF approved Value Added Tax.

Gambia has a clueless, feckless and ruthless government, that has ensured the central command will have fat salaries and expanding waistlines. While the poor and the uneducated can go to hell.

So what’s fresh ?