(JollofNews) – The Gambia is shouldering a domestic debt burden of D13.5 billion, representing 39 per cent of the country’s gross domestic product, the governor of the Central Bank of the Gambia says.

(JollofNews) – The Gambia is shouldering a domestic debt burden of D13.5 billion, representing 39 per cent of the country’s gross domestic product, the governor of the Central Bank of the Gambia says.

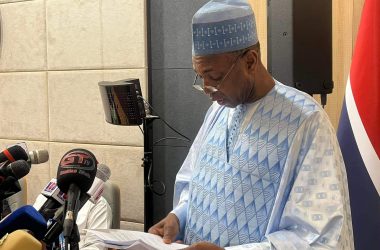

Amadou Colley said the country’s outstanding domestic debt as of 2013 has increased from 25.1 per cent in 2012 to 39 per cent of the country’s gross domestic product.

Treasury bills and Sukuk Al-Salaam have also increased to 34.5 per cent and 13.6 per cent and accounted for 81.0 per cent and 2.9 per cent of the country’s domestic debt.

Interest rates on Treasury Bills and Sukuk Al-Islam have increased from 9.62 per cent and 9.70 per cent in December 2012 to 15.85 per cent and 15.84 per cent in December 2013. Yields on the 182 day and 364 day Treasurer Bills has also increase to 17.0 per cent and 18.51 per cent from 10.20 per cent and 10.9 per cent respectively.

Mr Colley said the Gambia’s budget deficit including grants has made an 8 per cent increase from 2013 to D2.7 billion. He added that D2.2 billion (6.0 per cent of GDP) from domestic sources was used to finance the deficit.

He added that the Gambia is spending D578.8 million to service external debts and D172.7 in repayments.

“The consequences of financing the fiscal deficit through advances by the central bank, limits the ability of monetary policies to have the desired impact, the governor said.

“It has contributed to the macro-economic instability increasing depreciation and inflationary pressures and stifled the growth.”