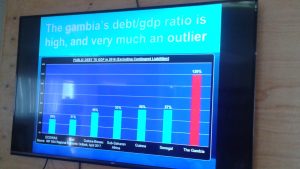

(JollofNews) – Gambia remained the highest debtor among the International Monetary Fund (IMF) Sub-Saharan Africa Member countries with a 120 percent debt compared to Guinea Bissau which holds only 46%, according to the Fund’s April 2017 Sub-Saharan Africa regional economic outlook.

Gambia is followed on the debt ratio by its closest neighbouring country Senegal with 57%, Guinea 56%, and the West African regional bloc, Ecowas with 29%.

During a powerpoint presentation at a luncheon she organised for Gambian journalists reporting on economics at the UN House at Cape Point, Bakau on Thursday, IMF resident representative Ruby E.M Randall said the fund has a total of 189 member countries. She said the global funding Argent is focused on global monetary corporation and providing assistance for balance of payment support where necessary.

In the 22 years rule of Gambia’s former President Yahya Jammeh who was defeated in the country’s last December election, the tiny West African nation’s IMF debt burden continue to accumulate substantially.

Ms. Randall said the country’s economic growth has slowed to just 2.3% in 2016 from 4.3% in 2015 due to droughts as a shortage of the forex and the political impasse from the last Presidential election. “Gambia’s debt on Gross Domestic Product (GDP) ratio is high and very much outlier. The new government inherited a heavy debt burden challenge.”

February next year, Gambia may table an appeal for debt cancellation before the IMF gathering to put the country on the road to economic recovery after years of unsettled debt dependency.

Mrs. Randall said IMF is largely a quota base institution with a total quota amounting to 750 million dollars and a further bilateral resource of about 500 million dollars.

Mrs. Randall said IMF is largely a quota base institution with a total quota amounting to 750 million dollars and a further bilateral resource of about 500 million dollars.

She said a Rapid Credit Facility (RCF) of 16.1 million dollars, equivalent to 18.75% of quota was approved on June 26 to help addressing Gambia’s high debt vulnerabilities and to help authorities to build a track record of good performance to pave the way for a transition Extended Credit Facility (ECF) agreement.

She said IMF is encouraged about the country’s economic recovery and growth because of a number of macroeconomic inflation. “Revenues are becoming more buoyant and the 91 days Treasury bills came down.”

I think these figures are reliable. I was surprised Jammeh did not do a UDI on the IMF. But perhaps these cash streams were too attractive.

It is a very sorry state of affairs, not helped by the self extravagance of the coalition.

I think what goes around comes around. The people are the sufferers especially the poorest and most vulnerable. The Gambia would do no worse than to employ an army of international economic experts joined by the IMF and Ecowas and the African bank to set out a clear and precise “Marshall plan” to do a total bank audit and create a proven economic system, to get Gambia moving.

I really do not think the coalition have the wisdom knowledge or expertise to address this increasingly dire and endless situation. But not many countries would either. Good to see other Ecowas nations doing very well and understanding tight fiscal policy and control.

Accumulating debts is not a crime, what is unacceptable is to use the debt unproductiveLy.

Exactly !!! Lets all fly to Medina or none at all.

5⭐️⭐️⭐️⭐️⭐️ Hotel bill x12 Months