The purpose of this paper is to give the Gambian government food for thought and advance my call for the establishment of a stock exchange in the Gambia.

The purpose of this paper is to give the Gambian government food for thought and advance my call for the establishment of a stock exchange in the Gambia.

The question as to whether the development of a stock market leads to economic development is one of the most documented questions in literature since Schumpeter’s pioneering work in 1912.

Applying this question to our Gambian scenario, the answer in my view will not be any different from the conclusion of Schumpeter in his “Theory of Economic Development”. He concluded that in developing a stock market, economic growth will be promoted by an efficient functioning financial system by selecting productive investments which are likely to succeed.

Several studies have been conducted on this question and the conclusions have all indicated a causal relationship between stock market development and economic development.

Whilst some research concluded a bidirectional causal relationship between stock market development and economic growth, Ananwude & Osakwe, (2017) concluded that in both short and long term, there is a positive but insignificant relationship between stock market development and economic growth.

The question now is, what is the Gambian government waiting for in facilitating the establishment of a stock exchange? The answer however is anyone’s guess but the advantages of having our very own stock exchange far outweigh the disadvantages.

The notion that the Gambian banking sector is sufficient as it is allocating credit which is assumed to be commensurate to the Gambian economy is nonsense. The fact that there is no interest rate liberalisation in the Gambia and the Central Bank is imposing an interest rate ceiling, it is making competition amongst banks difficult thereby stifling economic growth.

I recognise the constraints capital market operators will face if a stock market is created in the Gambia. These constraints include but not limited to inefficient credit allocation because of imperfect information in the market. This is where we expect our government and the Central Bank to encourage transparency in our financial institutions allowing for free flow of accurate information.

The mere fact that credit information of customers and potential customers is not readily available to lenders in the Gambia in a shared database is hampering efficient and effective decision making in providing credit.

The Gambian technological infrastructure is underdeveloped and needing intelligent investment to boost economic growth. With poor electricity supply and slow or near stagnant internet traffic in the Gambia, file share and database development will remain but a dream. What Gambia needs is a dedicated and selfless breed of elites whose resolve is nothing but to advance the National Development Plan, the UN’s SDGs and AU’s Agenda 2063.

Without a stock market in the Gambia and with the Central Bank applying interest rate ceilings, investors are left at the mercy of local banks who will either avoid lending to new and innovative investors because of the high risk of default associated with new borrowers or charge a risk premium on the lending rate.

This will on the one hand encourage riskier investors who believe that “the higher the risk, the higher the return”.

On the other hand, risk averse investors will be discouraged from investing due to the risk premiums applied on lending rates thus depriving the nation of a well-deserved investment, hence low economic growth. If the Central Bank lifts the interest rate ceiling, the forces of demand and supply will force the local banks to self regulate and compete against each other based on information prevailing in the market.

We expect the government to prioritise the institutional reform programs they have promised and review the Financial Instructions (FI) and the existing tax regimes.

By strengthening institutions and promoting transparency, Gambia will be moving towards system change which is a pillar for sound micro and macro-economic development. Simply changing heads of departments or moving people around is a recipe for failure.

The government needs to look at existing systems and structures and assess whether these are needed in the 21st century. Offices filled with piles of paperwork to be review manually is not the most effective use of people’s time. There should be a high drive towards automation, cashless offices within government and transactions to be conducted without cash. The more cash there are in offices, the higher the risk of fraud and embezzlement. Systems need to be developed which will be interfaced with the banking system to minimise the use of cash in transactions and payments.

Studies by Guglielmo Maria Caporale and others has revealed that by liberalising financial markets and letting the market allocate capital, a more efficient allocation of capital is achieved. They argued that if the financial market is composed of banks only, the market will fail to achieve efficient allocation of capital because of the shortcoming of debt finance in the presence of asymmetric information.

This supports my argument that the Central Bank should desist from imposing interest rate ceilings and let the forces of demand and supply take their natural course. There is therefore a need to establish a stock market in the Gambia which will see full efficiency of capital allocation.

Pessimists will argue that we do not need a stock exchange simply because of poor electricity and poor technological infrastructure, but this is a narrow view. The broader view according to Guglielmo Maria Caporale and others is that a stock market will finance risky, productive and innovative investment projects, unlike banks which tend to finance only well-established, safe borrowers.

One of the benefits of a stock market is that it constitutes a liquid trading and price determining mechanism for a diverse range of financial instruments. This allows risk spreading by capital raisers and investors and matching of the maturity preferences of capital raisers (generally long-term) and investors (short-term). This in turn stimulates investment and lowers the cost of capital, contributing in the long term to economic growth.

On this basis, there is an urgent need for consultation and collaboration between government (Ministry of Trade), the Central Bank, Gambia Chamber of Commerce and Industry, the banking industry and legislature. This consultation will open a debate and review of our existing financial systems and instruments, gap analysis of what is missing and a strategy to deliver a stock market.

The Gambia is in dire need of a Financial Conducts Authority which will authorise and regulate financial institutions, and anyone involved in financial instruments and products. This institution must be independent of the Central Bank and the Government, established by an act of parliament with checks and balances to ensure its independence.

The Gambia Financial Conducts Authority (GFCA) will also regulate and authorise individuals who provide financial instruments and products.

This institution will ensure that Financial markets are honest, fair and effective so that consumers get a fair deal. Like the UK’s FCA and the US SEC, the Gambia Financial Conducts Authority will have the following operational objectives:

• protect consumers – to secure an appropriate degree of protection for consumers

• protect financial markets – to protect and enhance the integrity of the Gambian financial system

• promote competition – to promote effective competition in the interests of consumers.

The Central Bank of the Gambia in my view is not fit to be responsible for regulating and authorising financial institutions. My reason being that as a regulator, there is a need for timely availability of information to protect consumers, protect financial markets and promote competition.

Since the Central Bank has not bothered to publish their own Annual Reports and Financial Statements over the last two years on their website (latest report being 2015) as at today 10th February 2018, I cannot see how they will ensure that the markets are honest, fair and effective so that consumers get a fair deal.

The Central Bank of the Gambia had 4 trillion Dalasis in circulation as at end of 2015 and there has been several notes printed and issued with less coins minted since then. These notes have been in high denominations of D200 and D100 notes which is a recipe for corruption. Studies suggest that the high volume of aggregate currency in circulation and large denomination banknotes are both statistically significant determinants of corruption. What the Central Bank needs to do is to work on reducing the volume of high denomination notes in circulation which is a generally acceptable tool to curb corruption.

We need to rise above all odds and fight for economic freedom in the Gambia where the national cake is equitably distributed for the benefit of every man and woman. We need a system where the weak and the poor are lifted from their predicament and economic exploitation by the strong and rich becomes history.

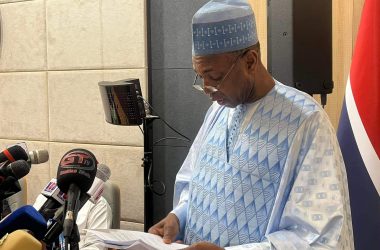

Nuha Ceesay

Leeds, United Kingdom

A Stock Exchange and a Commodity Trading Floor are way overdue for The Gambia.

However, TRUST, HONOR AND TRANSPARENCY are key prerequisites for the establishment of these structures in The Gambia.

There’s no room for Mafioso style brinkmanship in this undertaking.

Nuha, there’s nothing stopping you from attempting to set up a private Board of Trade or a trading body in The Gambia.

Where you run into bureaucratic red tape, corrupt practices and other imposed barriers to entry, blow the whistle on individuals and entities seeking to block the path. Then go further to seek assistance from the donor community and/or foreign missions to enable a solid foundation to the undertaking.

Keep your head up high and go working on this venture. Remember to keep members of this forum posted. Kudos on the proposal.

Alieu Faal’s 2017 article.

https://jollofnews.gm/2017/06/29/new-gambia-stock-exchange-market-needed-to-revive-the-sick-economy/

Sounds good, apart from debt and credit swaps derivatives,

What private Gambian companies would trade on the floor of this Gambian financial exchange,

Say, Gambian 100 index Or even Gambian 20 index?

Also,

Nuha Ceesay, you can come back home to The Gambia and open that stock exchange your self

All stock exchanges are privately owned, you only need to apply for a license from the Gambian Government, I for sure will support you in your endeavours,

First you create a company, register the company in The Gambia, then apply for your license.